Apple stock reached a new all-time high of $280.38 on Tuesday, surpassing its previous peak of $277.32 and lifting the company’s market value to $4.12 trillion.

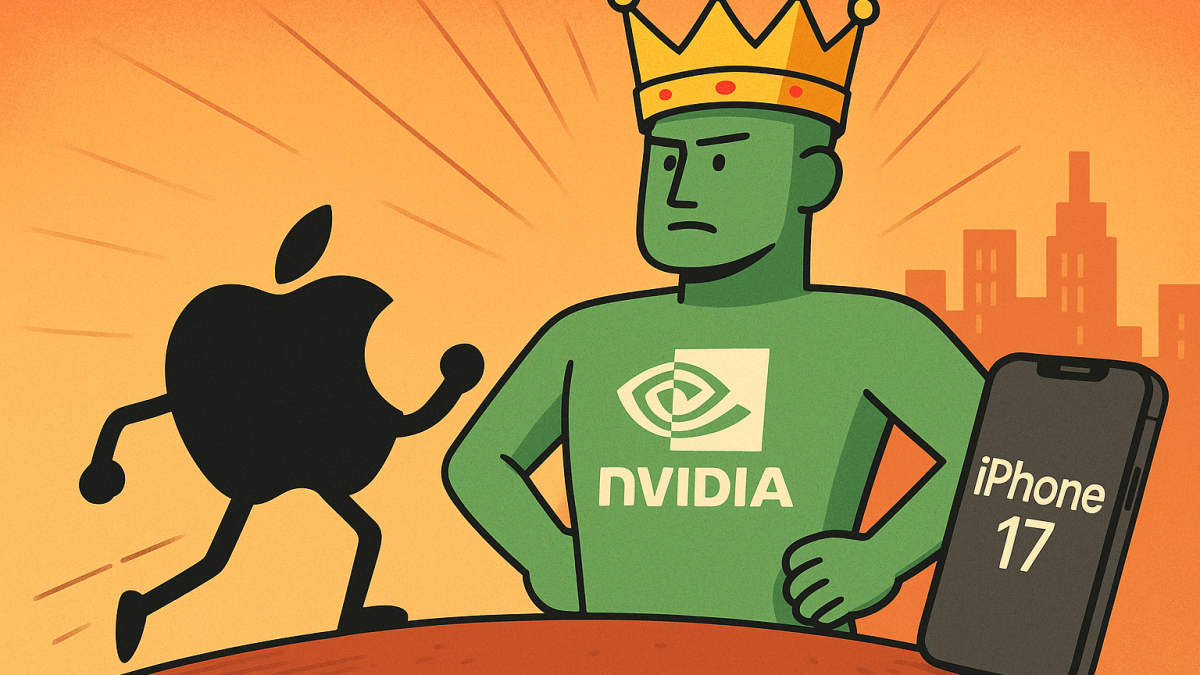

The milestone comes after a year of strong share performance and brings Apple within striking distance of overtaking Nvidia to reclaim the title of the world’s largest publicly traded company.

Nvidia, which has surged on the strength of the artificial intelligence boom, fell sharply during the session and hit its lowest level in nearly three months.

Shares were down as much as 6% in early trading before trimming losses to around 3%, leaving the chipmaker with a market capitalisation of about $4.28 trillion.

CNBC’s Jim Cramer said the decline was a buying opportunity, arguing that Nvidia’s fundamentals remain strong and demand for its AI platforms is “insatiable.”

Apple announces layoffs

Even as its market valuation rose, Apple confirmed on Monday that it is cutting jobs across its sales organisation as part of an effort to strengthen customer engagement.

The company said only a small number of roles would be affected.

Bloomberg reported that the layoffs include account managers serving large corporate clients, schools, and government agencies, as well as staff who run Apple’s briefing centres for institutional meetings and product demonstrations.

One of the key groups impacted was a government sales team working with agencies including the US Department of Defense and Department of Justice, according to the report.

Apple set to reclaim global smartphone crown

In a separate development, Apple is poised to retake its position as the world’s largest smartphone maker for the first time since 2011, according to estimates from Counterpoint Research cited by Bloomberg.

The shift is being driven by the strong global performance of the iPhone 17 series, introduced in September.

The new models have generated double-digit year-over-year sales growth in both the United States and China, Apple’s two most important markets.

Counterpoint analysts said a combination of successful product reception, cooling US-China trade tensions, and a weaker dollar boosting purchasing power in emerging markets contributed to the momentum.

The firm projects iPhone shipments will grow 10% in 2025, compared with an expected 4.6% increase for Samsung, allowing Apple to reclaim the top spot.

The broader smartphone market is forecast to expand 3.3% this year, with Apple projected to capture a 19.4% share.

Counterpoint analyst Yang Wang said the industry is entering a pivotal point in the replacement cycle.

“Beyond the highly positive market reception for the iPhone 17 series, the key driver behind the upgraded shipment outlook lies in the replacement cycle reaching its inflection point,” he said.

He added that 358 million secondhand iPhones sold between 2023 and the second quarter of 2025 are likely to contribute to future upgrades as users migrate back into the new-device ecosystem.

With Apple closing the gap on Nvidia in market capitalisation and set to reclaim leadership of the global smartphone market, investors appear increasingly confident in the company’s near-term outlook and its ability to sustain momentum into 2025.

The post Apple stock at all-time high: layoffs, iPhone 17 success, and the race against Nvidia appeared first on Invezz