Qualcomm Inc (NASDAQ: QCOM) is reportedly interested in taking over Intel Corp (NASDAQ: INTC) to potentially strengthen its footprint in servers and the PC market.

But the AI darling Nvidia Corp (NASDAQ: NVDA) could be a better suitor for the once-dominant chipmaker that’s lost more than 60% in 2024. Why? Because it has significantly more capital and resources to optimally transform INTC.

Nonetheless, it’s more than just numbers. Taking over Intel makes strategic sense for Nvidia as well. Here’s why.

Should Nvidia consider taking over Intel?

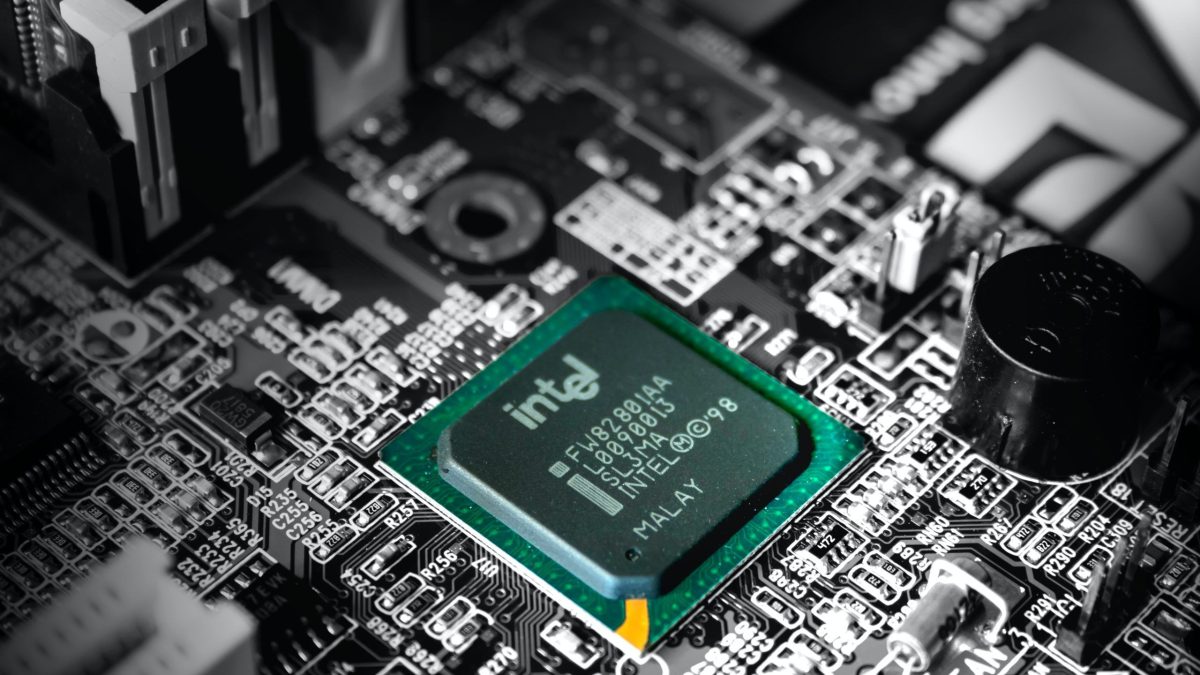

Intel supplies CPUs for data centres and personal computers.

That makes Nvidia particularly well-positioned to capitalise on an INTC buyout and expand its business with the existing customers as it already is a top supplier of GPUs in both those markets.

Additionally, Intel is committed to broaden its reach in graphic processing units with its more sophisticated chip dubbed the Gaudi 3.

Therefore, taking over the semiconductor giant will reduce competition for NVDA as well.

However, the overlap in markets where Intel and Nvidia are most active, along with potentially lesser competition means the artificial intelligence behemoth will likely face material regulatory hurdles if it were to propose an acquisition of INTC.

So, while Intel’s assets may be worth so much more to Nvidia, they are unlikely to fall in its lap without significant challenges.

Intel’s foundry business may be attractive for NVDA

Note that Nvidia is primarily a chip designer and not a foundry, which is to say, it outsources the production of silicon to the likes of TSMC.

But a buyout of Intel could help shield NVDA from geopolitical tensions such as the escalation of trade tensions with China since it would then have in-house capability to manufacture its own chips.

That’s particularly significant considering Intel is making strides in chip fabrication.

The company expects to begin mass production of sub-2-nanometre chips by the end of 2024 – about a year before TSMC.

Simply put, Intel’s most advanced 18A manufacturing technology may be a meaningful benefit for Nvidia considering it primarily focuses on avant-garde GPUs for AI related tasks.

Nvidia can pay more to buy Intel

If Nvidia were to go after Intel, it may be able to pay up to 50% more for it as well.

That’s because NVDA is currently a $3.0 trillion company with some $35 billion in cash.

In comparison, Qualcomm’s market cap currently sits under $200 billion only and its cash stature is capped at less than $10 billion.

Nonetheless, while it’s financially viable and strategically beneficial for Nvidia to buyout Intel, there have been no reports of formal talks between the two companies so far.

The post Nvidia is a far better suitor for Intel than Qualcomm appeared first on Invezz