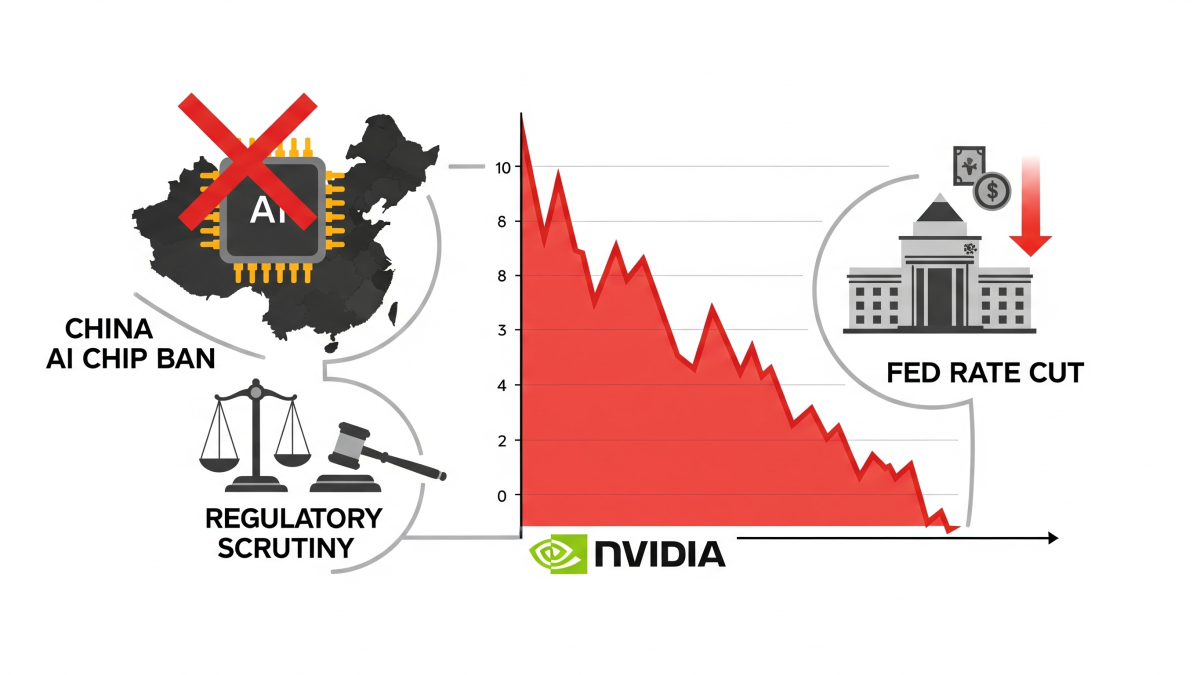

Shares of Nvidia extended its downward trajectory on Wednesday after the US Federal Reserve lowered the benchmark interest rate.

The economic event did not help arrest the slide in Nvidia as the S&P 500 fell after posting slight gains after the Fed’s decision.

China blocks Nvidia’s AI chip sales

Nvidia shares fell after a Financial Times report that China’s internet regulator had banned the country’s largest technology firms, including Alibaba and ByteDance, from buying or testing its advanced artificial intelligence chips.

Nvidia shares had fallen 3.41% to $168.92 at the time of writing.

The decision immediately heightened concerns over the company’s exposure to one of its most important markets.

The products affected include the RTX Pro 6000D and H20 models.

The ban marks a significant setback for Nvidia, as China accounted for roughly 13% of its sales last year.

The move underscores Beijing’s more assertive approach to regulating foreign technology and limiting reliance on US chipmakers, while simultaneously accelerating efforts to build homegrown alternatives.

Chinese authorities cited security risks as part of their reasoning, reportedly expressing concerns that Nvidia’s chips could contain features that allow remote monitoring or control.

Nvidia has rejected such claims. The ban comes on top of ongoing investigations into Nvidia’s market practices, further complicating its position in China.

Regulatory scrutiny adds to investor caution

Beyond the ban, regulatory pressure on Nvidia is mounting. China’s State Administration for Market Regulation has reopened its antitrust review of Nvidia’s 2020 acquisition of Mellanox Technologies, a deal that was previously cleared.

The decision has caught investors off guard, raising uncertainty about potential penalties or new conditions that could disrupt Nvidia’s business in the region.

The company’s challenges in China are already evident.

Sales of the H20 chip — designed specifically to comply with US export restrictions — have fallen to zero in recent earnings reports.

The lack of traction highlights how difficult it has become for Nvidia to navigate a market where trade rules and political pressures are shifting rapidly.

Chief Executive Jensen Huang acknowledged the difficulties during remarks in London, describing Nvidia’s experience in China as “a bit of a rollercoaster.”

He emphasized that the company can only operate in markets where it is welcome and noted that analysts have been guided not to include China in forward-looking forecasts.

Huang suggested that Nvidia’s fate in China now depends more on government negotiations between Washington and Beijing than on its own corporate strategy.

Fed decision

The broader markets reacted positively to the Federal Reserve’s latest policy move even as Nvidia struggled.

The Fed lowered its benchmark interest rate by a quarter percentage point to 4%–4.25%, the first cut since December, and signaled two more reductions by year’s end.

The decision, aimed at addressing a weakening labor market even as inflation remains elevated, boosted investor sentiment.

The S&P 500 fell after posting a brief up move after the Fed’s decision.

The post Nvidia shares extend losses after US Fed cut interest rate appeared first on Invezz