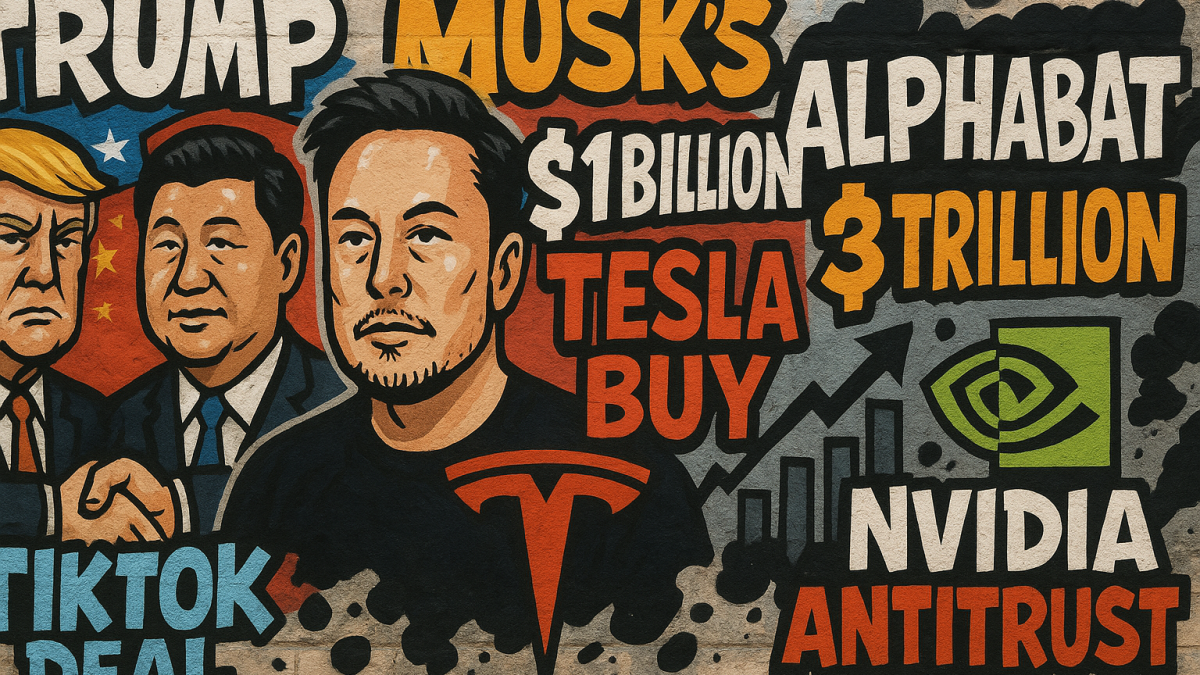

Global markets and political circles witnessed a flurry of key developments on Monday evening, ranging from high-level diplomatic talks to major corporate milestones and regulatory scrutiny.

US President Donald Trump confirmed direct talks with Chinese President Xi Jinping, Tesla CEO Elon Musk executed a $1 billion insider share purchase, Alphabet crossed the $3 trillion market capitalization threshold, and Nvidia came under fresh antitrust pressure in China.

US–China nears a TikTok deal

President Donald Trump announced on Monday that he will hold direct talks with Chinese President Xi Jinping on Friday, marking a critical new phase in US–China negotiations.

The announcement followed discussions between US and Chinese officials in Spain, where both sides sought to resolve long-standing economic and security disputes.

Trump suggested progress had been made not only on broader trade issues but also on the fate of TikTok, owned by China’s ByteDance.

The popular video-sharing platform faces a deadline this week to restructure its US operations under national security law.

Trump, in a social media post, hinted at a resolution involving a “certain company that young people in our Country very much wanted to save,” widely interpreted as TikTok.

Musk’s $1 Billion Tesla share buy draws attention

Tesla was thrust into the spotlight after CEO Elon Musk purchased roughly $1 billion worth of Tesla shares, according to a regulatory filing.

The acquisition, executed through a trust, represents one of the largest insider buys in the company’s history.

The timing of the purchase is significant, coming as Tesla faces intense debate over a potential pay package for Musk, which could exceed $1 trillion if the company achieves ambitious performance and market value targets.

Tesla shares gained in Monday’s session.

Alphabet joins $3 trillion market cap club

Shares of Alphabet surged more than 4% in New York trading, with Class A stock rising 4.6% to $251.88 and Class C stock advancing 4.5% to $252.30, both at record highs.

The company now joins Apple, Microsoft, and Nvidia in the exclusive $3 trillion club, with Nvidia continuing to lead the group at over $4 trillion in valuation.

Alphabet’s achievement comes nearly two decades after Google’s IPO and just over ten years after its restructuring into a holding company.

Alphabet shares have risen more than 30% this year, outpacing the Nasdaq Composite and underscoring strong investor confidence in its cloud, advertising, and AI businesses.

Nvidia faces antitrust scrutiny in China

Meanwhile, Nvidia encountered fresh regulatory challenges as China’s State Administration for Market Regulation (SAMR) announced preliminary findings that the chipmaker had violated the country’s anti-monopoly law.

The probe centers on commitments Nvidia made in 2020 when China approved its $7 billion acquisition of Israeli chip designer Mellanox Technologies.

While SAMR did not specify the nature of the violations or potential penalties, it confirmed that investigations would continue.

The announcement weighed on market sentiment, with Nvidia shares falling into red in the session.

The development highlights the delicate position of US tech firms as Washington and Beijing continue to clash over access to advanced technology.

The post Evening digest: Musk buys $1B Tesla shares, Google hits $3T, US China nears TikTok deal appeared first on Invezz