Blaize Holdings Inc (NASDAQ: BZAI) sees a serviceable addressable market of about $71 billion collectively for video security, enterprise edge, and autonomous systems – its chosen verticals within artificial intelligence by 2028.

It’s a bold claim for a company that listed on Nasdaq only this week.

Even a more established name like Broadcom Inc. currently estimates its AI serviceable addressable market in the range of $60 billion to $90 billion by 2027.

Blaize stock is down nearly 3.0% at writing on Wednesday.

Raised tariffs are unlikely to hurt Blaize

Blaize opted for a SPAC merger with BurTech Acquisition to go public at a valuation of $1.2 billion on January 14th.

The new capital will help “accelerate our go-to-market functions, our roadmap, and also to hire additional talent as we grow the business,” according to the company’s chief executive – Dinakar Munagala.

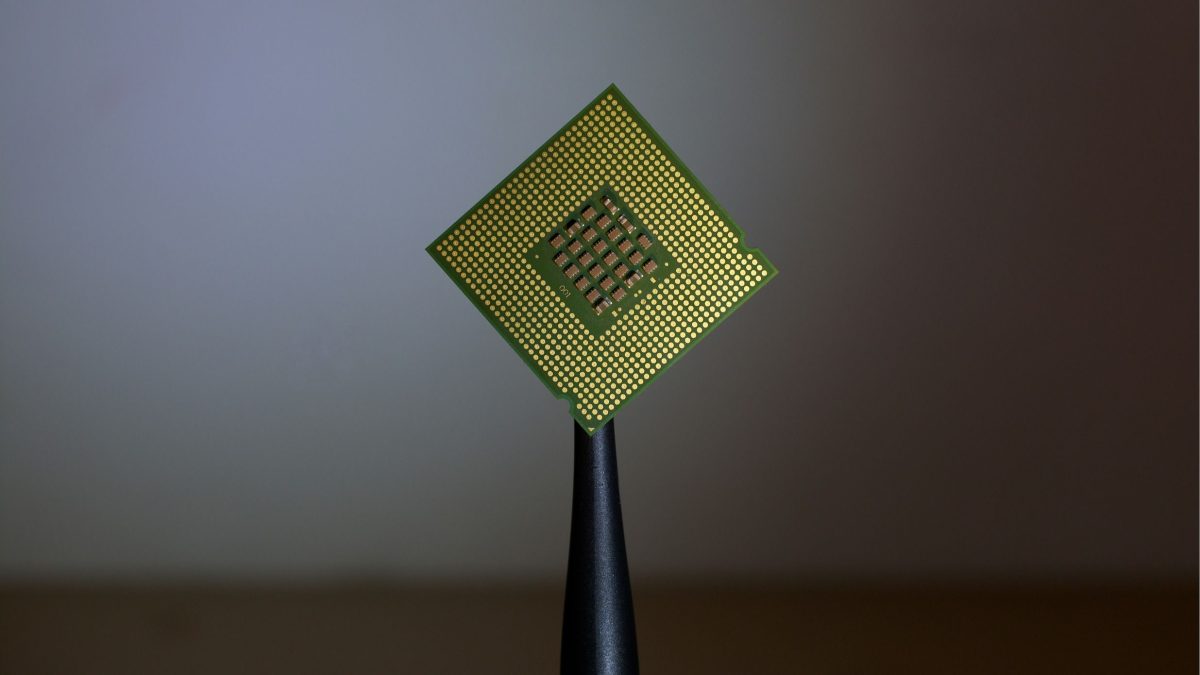

Blaize is among the very few AI chip companies that manufacture on US soil. It relies almost entirely on domestic suppliers like Plexus and Supermicro for components and is, therefore, insulated from the impact of potentially raised tariffs under the Trump administration.

On-shore production and supply chains are making the defense industry take a particular interest in Blaize as well, Munagala revealed in an interview with CNBC today.

Blaize is insulated from chip export restrictions

The incoming US government hasn’t fully disclosed its stance on regulations related to the export of AI chips so far.

That could spur uncertainty for Blaize considering an order from an unnamed defense entity in the Middle East represents a quarter of its $400 million pipeline.

But CEO Dinakar Munagala sees no threat to business even if Donald Trump takes just as aggressive of a stance on chip exports as Joe Biden.

“A lot of the restrictions are on AI high-end training systems. There are no export control restrictions on our class of products,” he said this morning on “Worldwide Exchange”.

Should you invest in Blaize stock today?

All in all, Blaize is an emerging name among AI semiconductor and software companies. Among its notable investors are Daimler, Samsung, and Denso.

Financial investors, including Temasek and Franklin Templeton, are invested in Blaize as well.

But those interested in loading up on its recently listed shares should also know that it’s not yet a profitable company – neither is it expected to turn a profit anytime soon.

So, Blaize could prove to be a lucrative investment if succeeds in winning more contracts and pushing quickly towards profitability.

However, its current financial stature and regulatory uncertainties make it a high-risk investment as well – and Blaize stock doesn’t currently pay a dividend to incentivize those who choose to take the risk.

The post AI chipmaker Blaize sees $71B market across video security, and autonomous systems by 2028 appeared first on Invezz